Asset class: Business Development Companies (BDCs)

Assets: GSBD – Goldman Sachs BDC, BCSF – Bain Capital Specialty Finance, GBDC – Golub Capital BDC

What are BDCs?

Business Development Companies (BDCs) are publicly traded investment vehicles that provide debt or equity financing to small and mid-sized private U.S. businesses, often those underserved by traditional banks. In exchange, BDCs earn high interest income or potential equity upside and are legally required to distribute at least 90% of their income to shareholders, making them attractive for yield-focused investors. While they offer access to private credit strategies typically reserved for institutions, BDCs come with notable risks, including high volatility, credit exposure, and limited transparency in their underlying portfolios.

BDCs have many similarities with private credit funds that we’ve chosen to allocate to in the past - but the differences are simple. BDCs are exposed to more volatility than private credit funds (due to being publicly listed), but offer deeper liquidity. This tradeoff has the potential to be interesting for Noon’s deployments.

Read our full BDCs Primer for a detailed walkthrough of how they work, risks, examples, and trusted learning resources.

Here are a few details of the more notable BDCs:

GSBD – Goldman Sachs BDC

Manager: Goldman Sachs Asset Management

Focus: Middle-market lending, predominantly senior secured loans

Yield Profile: Historically offers attractive dividend yields (~9–11%)

Strengths:

- Backed by Goldman Sachs’ institutional credit research and origination network

- Focus on first-lien senior secured loans provides structural protection

- Conservative leverage relative to peers

Considerations:

- Merged with Goldman Sachs Middle Market Lending Corp in 2020 to scale

- Portfolio somewhat concentrated in certain sectors (e.g., software, healthcare)

- Sensitive to credit cycles and borrower defaults due to exposure to leveraged companies

BCSF – Bain Capital Specialty Finance

Manager: Bain Capital Credit

Focus: Senior secured loans to middle-market companies, with select exposure to subordinated debt

Yield Profile: Competitive dividends (~9–10%), relatively stable

Strengths:

- Part of Bain Capital’s global private investment platform with deep credit expertise

- Broad diversification across industries (over 100+ portfolio companies)

- Emphasis on conservative underwriting and downside protection

Considerations:

- Slightly higher allocation to non-first lien debt than some peers

- NAV has shown some volatility in periods of market stress

- Returns can be impacted by macroeconomic shifts affecting borrower performance

GBDC – Golub Capital BDC

Manager: Golub Capital

Focus: First-lien senior secured loans, primarily to U.S. sponsor-backed companies

Yield Profile: Slightly lower than peers (~7–9%), but with lower volatility

Strengths:

- Known for underwriting high-quality credits with strong financial sponsors (e.g., PE-backed deals)

- Historically lower loan loss rates than peer BDCs

- Conservative investment approach and strong historical credit performance

Considerations:

- More conservative risk profile means slightly lower yields

- Portfolio concentrated in certain sectors like software and healthcare services

- Less trading volume than larger BDCs, which may impact liquidity for public shareholders

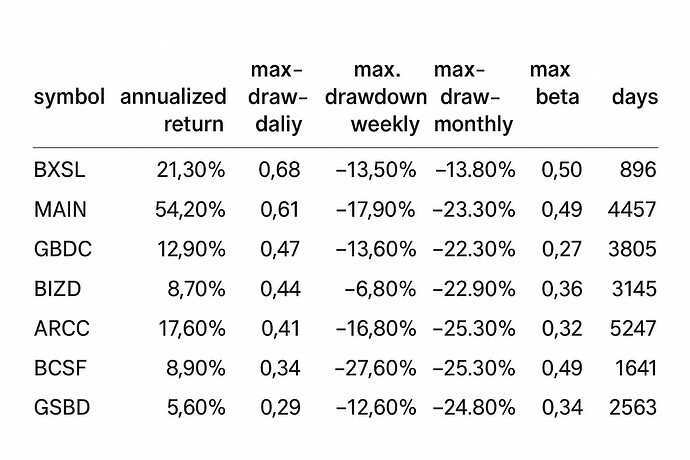

Key statistics for prominent BDCs

Noon Risk Assessment: Summary

Noon Risk Assessment: Details

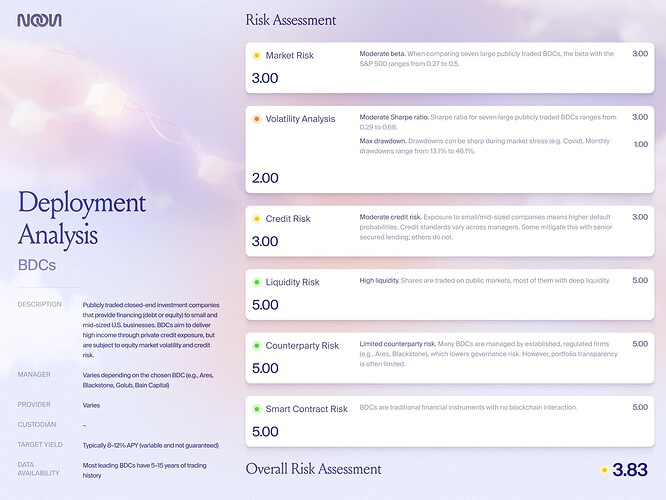

Market Risk

Moderate — BDCs have a beta between 0.27 and 0.5 vs. the S&P 500, meaning they do exhibit public equity market sensitivity, especially in stressed conditions.

Volatility Risk

Moderate Sharpe Ratio — While some BDCs show moderate Sharpe ratios (0.29–0.68), drawdowns can be severe. During COVID, the worst monthly drawdowns ranged from -13.1% to -46.1%.

Credit Risk

Moderate — BDCs lend to smaller, riskier borrowers, with credit quality and underwriting varying by manager. Some focus on senior secured debt (e.g., Golub), while others take more subordinated risk.

Liquidity Risk

Low — BDCs are publicly traded and offer daily liquidity via public markets. Most have strong trading volume and market depth.

Counterparty Risk

Low — Most leading BDCs are managed by reputable, regulated firms like Blackstone, Ares, and Bain Capital, though transparency into the underlying portfolio varies.

Smart Contract Risk

None — BDCs are traditional financial products and don’t interact with blockchain systems.

Our analysts’ recommendation

We have performed the analysis on BDCs to share with our community, and allow our users the opportunity to weigh in on whether Noon’s capital deployment should extend to BDCs.

After our analysis, for several reasons, our analysts recommend that we do not add BDCs to Noon’s permissible deployment strategies at this time. Why?

The short version: BDCs are too volatile for Noon’s current strategy. Because USN is a stablecoin, its collateral value should not be exposed to price swings. That’s why we’re only looking for delta-neutral strategies, or ones with very low price volatility. Noon only incorporates yield sources with stable and predictable returns—qualities BDCs currently don’t provide due to their exposure to public market price swings.

Additionally, while yields can be high, they’re not guaranteed—and the underlying portfolios of BDCs can be opaque and illiquid. We do not believe that the risk-return trade-off, or maybe the volatility-return trade-off, fits into our basket of deployment strategies at this time.

However, our analysts do recommend that we keep an eye on BDCs - and review new assets in this class, in addition to quantitative deployment strategies that deploy into this asset class. There is something extremely compelling about the ability to access the types of instruments that BDCs can uniquely deploy into - but we believe additional work must be done for Noon to deploy in a comfortable manner.

Let’s Open the Discussion, Noon Community:

Let’s Open the Discussion, Noon Community:

While our recommendation is clear, the ultimate decision is up to our users. We invite you to participate in the discussion below on whether to add BDCs to our basket of deployment strategies in our governance forum for the next 3 weeks. After that, we will invite all $sNOON holders to cast their votes in our voting forum to officially include or exclude BDCs from our permitted deployment strategies.

In the the discussion below, please let us know your thoughts on the following questions:

-

Do you think BDCs should be added to Noon’s basket of deployment strategies?

-

If so, which BDCs do you think fit the best with Noon’s risk-return profile, and complement our other deployment strategies?

We’re evaluating all angles and looking to learn from our community as we explore the potential of this asset class.

Drop your comments below. Let’s think through this together ![]()