Asset class: CLO

CLOs are structured credit instruments backed by diversified portfolios of corporate loans. They’ve historically outperformed treasury bills with relatively low volatility, deep liquidity, and institutional activity. This makes them an attractive and logical next step for Noon Capital to explore as we scale yield generation while maintaining our security commitment. We will be specifically evaluating Janus Hendersen’s JAAA and JBBB CLO products.

For a brief primer on CLOs, please see here.

Asset: JAAA

The Janus Henderson AAA CLO ETF (ticker: JAAA) is an actively managed exchange-traded fund that provides investors with exposure to high-quality, floating-rate AAA-rated collateralized loan obligations (CLOs). Launched in October 2020, JAAA has grown to become the largest CLO ETF by assets under management (AUM), surpassing $20 billion as of early 2025.

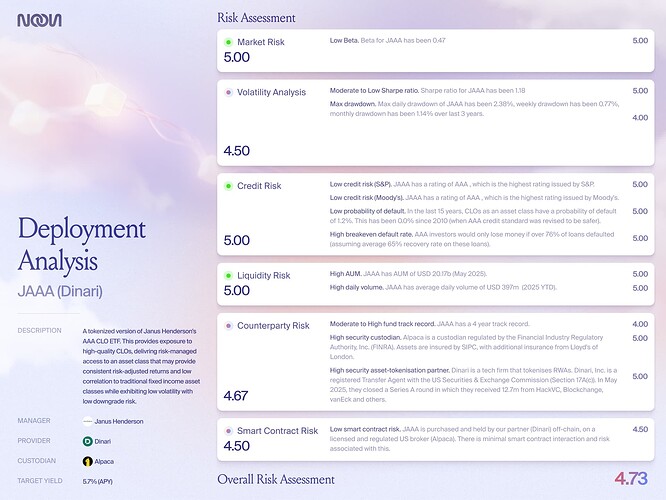

Noon Risk Assessment: Summary

Noon Risk Assessment: Details

Market Risk

JAAA has a low beta against the S&P 500 (0.47 from Oct 2020 to May 2025), indicating a low systematic market risk exposure. Low beta assets fit portfolios designed for capital preservation, defensive positioning, and lower correlation to equity market events.

Volatility Risk

JAAA has a moderate to high Sharpe ratio of 1.18 is strong for a conservative fixed-income strategy. For context, equity funds average 0.5 to 0.8 Sharpe ratios, while bond ETFs average 0.5 to 1.0. Sharpe ratio >1.0 in a low-volatility asset is excellent. It reflects stability and meaningful return generation.

JAAA’s max daily drawdown of 2.38%, weekly drawdown of 0.77%, and monthly drawdown of 1.14% is excellent for this asset class. On a daily basis, for comparison, high-yield or even investment-grade bond funds have seen 5–10%+ daily drawdowns during stressed markets. And on the other extreme, on a monthly basis, most bond or credit ETFs saw multi-percent monthly drawdowns during 2022–2023 rate hikes. JAAA performing well in both market conditions is an excellent signal for low volatility.

Credit Risk

JAAA is well-positioned from a credit risk standpoint, underpinned by its AAA ratings from both S&P and Moody’s—the highest possible ratings and a clear signal of strong credit quality and minimal default risk. The underlying asset class, AAA-rated CLO tranches, has shown an impressive long-term track record, with just a 1.2% historical default rate over the past 15 years and zero defaults since 2010, following a tightening of credit standards.

Furthermore, the structural resilience of these CLOs is underscored by their high breakeven default threshold: investors in AAA tranches would only face losses if more than 76% of the underlying loans defaulted, even assuming a conservative 65% recovery rate. These metrics collectively highlight JAAA’s robustness and make it a compelling choice for investors seeking high-quality, low-credit-risk fixed income exposure.

Liquidity Risk

JAAA exhibits strong liquidity characteristics, which significantly reduce liquidity risk for investors. With assets under management (AUM) of $20.17 billion as of May 2025, JAAA is one of the largest ETFs in the structured credit space, providing ample scale and investor confidence. Complementing this, its average daily trading volume of $397 million (2025 YTD) ensures high secondary market liquidity, enabling investors to enter and exit positions efficiently with minimal price impact. Together, these figures reflect a deep and active market for JAAA, making it a highly liquid vehicle even in times of market stress.

Counterparty Risk

Our deployment strategy into JAAA via Dinari and Alpaca is well-supported from a counterparty risk standpoint, combining credible infrastructure with regulatory oversight and strong security practices. JAAA itself has a solid four-year track record, providing confidence in its operational reliability and performance consistency. On the custody side, Alpaca is a FINRA-regulated broker-dealer with SIPC insurance coverage, further backed by additional protection from Lloyd’s of London, ensuring high standards for asset safeguarding. Meanwhile, Dinari, our asset-tokenization partner, enhances trust through its status as a registered SEC Transfer Agent under Section 17A(c) and its backing by credible institutional investors—including HackVC, Blockchange, and vanEck—in a recent $12.7 million Series A round. Together, these elements create a secure, regulated, and institutionally supported framework for allocating capital into JAAA with minimized counterparty risk.

Smart Contract Risk

Our deployment strategy into JAAA via Dinari and Alpaca is highly favorable from a smart contract risk standpoint, as it minimizes reliance on smart contracts that could be vulnerable to bugs or exploits. Since JAAA is purchased and held off-chain by Dinari through Alpaca, a licensed and regulated U.S. broker, the investment process minimises the complexity and potential failure points associated with on-chain custody or smart contract execution. This significantly reduces exposure to technical vulnerabilities, providing a more secure and stable infrastructure for accessing traditional financial assets through a modern, tokenized interface.