Asset class: DeFi Lending

Assets/Platforms: Morpho (preferred), Euler (select pools, liquidity permitting)

What is DeFi Lending?

DeFi lending protocols (e.g., Aave, Euler, Morpho) enable over-collateralised, on-chain borrowing and lending enforced by smart contracts. Lenders deposit assets (in our case USDC/USDT only) into liquidity pools to earn variable interest; borrowers post collateral worth more than the loan value. Rates auto-adjust with utilisation.

DeFi lending offers real-time transparency, programmable risk controls, and generally instant withdrawals subject to pool utilisation. For Noon, this strategy is attractive when paired with strict deployment limits and active insurance coverage.

Read our full DeFi Lending Primer for a detailed walkthrough of how it works, risks, examples, and our deployment rules (utilisation caps, insurance gating, monitoring).

Key statistics for prominent DeFi lending pools

Please find a comparison of APYs for major vaults on Aave, Euler, Morpho in this sheet. Lending APY comparison.

Noon Risk Assessment: Summary

**Noon Deployment Analysis – DeFi Lending (USDC/USDT only)

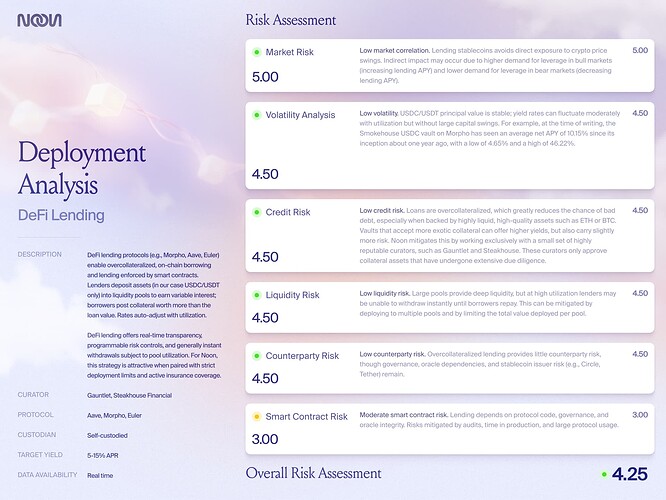

Market Risk

Low — Low market correlation. Lending stablecoins avoids direct exposure to crypto price swings. Indirect impact may occur due to higher demand for leverage in bull markets (increasing lending APY) and lower demand for leverage in bear markets (decreasing lending APY).

Volatility Risk

Low — Low volatility. USDC/USDT principal value is stable; yield rates can fluctuate moderately with utilisation but without large capital swings. For example, at the time of writing, the Smokehouse USDC vault on Morpho has seen an average net APY of 10.15% since its inception about one year ago, with a low of 4.65% and a high of 46.22%.

Credit Risk

Low — Low credit risk. Loans are overcollateralized, which greatly reduces the chance of bad debt, especially when backed by highly liquid, high-quality assets such as ETH or BTC. Vaults that accept more exotic collateral can offer higher yields, but also carry slightly more risk. Noon mitigates this by working exclusively with a small set of highly reputable curators, such as Gauntlet and Steakhouse. These curators only approve collateral assets that have undergone extensive due diligence.

Liquidity Risk

Low — Low liquidity risk. Large pools provide deep liquidity, but at high utilization lenders may be unable to withdraw instantly until borrowers repay. This can be mitigated by deploying to multiple pools and by limiting the total value deployed per pool.

Counterparty Risk

Low — Low counterparty risk. Overcollateralized lending provides little counterparty risk, though governance, oracle dependencies, and stablecoin issuer risk (e.g., Circle, Tether) remain.

Smart Contract Risk

Moderate — Moderate smart contract risk. Lending depends on protocol code, governance, and oracle integrity. Risks mitigated by audits, time in production, and large protocol usage.

Our analysts’ recommendation

We’ve completed our initial analysis to invite community input on whether Noon should add DeFi Lending (USDC/USDT only) to its permitted deployment strategies.

Recommendation: Proceed conditionally — only using pools with deep liquidity, with insurance coverage and strict deployment rules. Why?

-

Stability-first fit: Lending stablecoins aligns with USN’s stability mandate and our requirement for low principal volatility.

-

Risk controls: We will enforce:

-

Utilisation sizing: Max exposure per pool = [(100% − kink%) * Pool Liquidity] (e.g. if a pool’s interest rate kink is set at 90% and the pool’s total liquidity is $100m, we’ll deploy a maximum of (1 - 0.9)*100 = $10m to this pool). In a pool with a kink at 90%, it’s expected that there will usually be approximately 10% of free liquidity for lenders to withdraw. Hence, if we keep our deployment under that threshold we will usually be able to withdraw all of our liquidity instantly.

-

Hurdle rate: Net APY must exceed T-bill + insurance cost.

-

Collateral screens: Only deploy into blue-chip collateral pools with deep liquidity.

-

Curator track record: Only deploy into blue-chip curators who have lengthy track record for managing pools without any incidents or credit issues.

-

Monitoring: Automated alerts for APY drops, utilization spikes, collateral shocks, etc.

-

-

Insurance gating: We will not deploy without insurance that covers relevant risks (e.g., smart contract exploits).

Together, these conditions support attractive, transparent yield with controlled downside.

Let’s Open the Discussion, Noon Community:

We propose adding DeFi Lending (USDC/USDT only) to Noon’s basket of permitted deployment strategies, subject to insurance and the constraints above. We invite discussion in this thread for the next 2 weeks. After that, we’ll open an official vote for all $sNOON holders to include or exclude DeFi Lending from our permitted strategies.

Steakhouse Risk Methodology

Steakhouse Financial applies a layered risk framework that combines governance safeguards, collateral quality standards, and independent risk scoring. Their vaults are protected by Aragon DAO guardians and timelocks, allowing liquidity providers to veto major changes, while curators like Carniceria Tropical enforce stringent governance protocols. The risk framework emphasizes three dimensions—social, decentralization, and technical—with assets graded from AA (institutional-grade, supervised, immutable) down to C (minimal protections). Institutional “Steakhouse” vaults focus on blue-chip assets with conservative onboarding, while “Smokehouse” vaults accept more exotic collateral in pursuit of higher yields, reflecting higher market and liquidity risk. Across all vaults, Steakhouse prioritizes transparency, due diligence, and depositor protection, relying on ongoing monitoring and independent frameworks (e.g., Credora risk scoring) to manage credit, counterparty, and market risks. For more information, please see:

-

https://docs.google.com/document/d/18ADHX_O2oQKjAfRLoLVbDUizKxWBA4w7g8KYsphj0N4/edit?tab=t.0

-

https://forum.morpho.org/t/key-information-on-steakhouse-branded-vaults/1343

Gauntlet Risk Methodology

Gauntlet curates Morpho Vaults using a data-driven, simulation-based risk framework designed to minimise insolvency risk even under extreme stress scenarios. Their Prime Vaults allocate only to highly liquid, blue-chip collateral markets and rebalance dynamically to preserve resilience. Risk is assessed across liquidity, price volatility, oracle integrity, and market mechanics, with allocations continuously adjusted based on agent-based simulations and historical drawdown data. Caps limit exposure to individual markets, and utilization thresholds ensure sustainable borrow and supply rates. A conservative liquidation strategy—tracking both slippage and liquidator ecosystem health—keeps expected insolvent debt below 10 bps of TVL. Together, Gauntlet’s automated monitoring and rebalancing, backed by experienced risk managers, aim to maximise risk-adjusted yield while maintaining near-zero insolvency risk.

For more information, please see: https://vaultbook.gauntlet.xyz/morpho-vaults

Discussion topics:

Let’s Open the Discussion, Noon Community:

We propose adding DeFi Lending (USDC/USDT only) to Noon’s basket of permitted deployment strategies, subject to insurance and the constraints above.

We’d love to hear your thoughts over the next 2 weeks before moving to a community vote.

You don’t need to answer every angle — just share what feels most important to you. For example:

-

Do you support adding DeFi Lending under these conditions?

-

Any concerns we should keep in mind (e.g., risks, pool selection, insurance)?

-

Anything we might be missing?

Drop your comments below ![]()